Partners Community Health is hosting a free Seniors Tax Clinic on April 16, 18 and 20 from 11:00am – 5:00pm. Community members living in Mississauga, that meet the eligibility criteria are invited to book an appointment with one of our volunteers that have been trained by Canada Revenue Agency.

Language support will be available on the following days:

| Tuesday, Apr 16 | Thursday, Apr 18 | Saturday, Apr 20 |

| English, Hindi, Gujarati, Punjabi | English, Hindi, Gujarati, Punjabi, Mandarin | English, Hindi, Gujarati, Punjabi, Mandarin |

See below to learn more about the eligibility criteria:

In order to be eligible for the CVITP, individuals must have a modest income and a simple tax situation.

This may include:

- adults 65 years and older

- housing-insecure individuals

- Indigenous Peoples

- modest-income individuals

- newcomers

- persons with disabilities

- students and youth

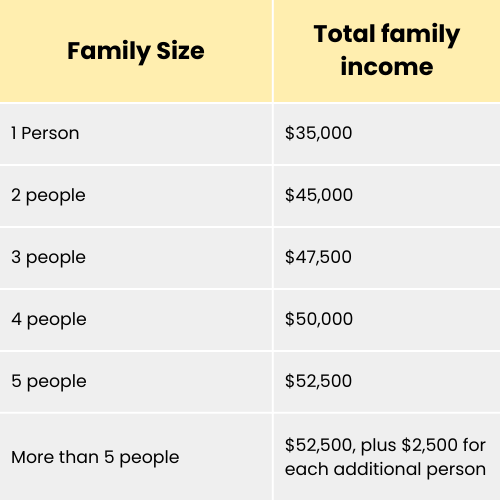

Modest Income

The following table provides a guideline to determine what is considered a modest income. In general, a modest income means the total family income is less than or equal to the amount shown in the chart below, based on the size of the family.

***Family size includes an individual, or a couple, and their dependents.

Simple tax situation

In general, a tax situation is simple if an individual has no income or if their income comes from these sources:

- employment

- pension

- benefits, such as the Canada Pension Plan, Old Age Security, disability insurance, employment insurance, and social assistance

- Registered Retirement Savings Plans (RRSPs)

- scholarships, fellowships, bursaries, or grants

- interest (under $1,000)

The CVITP does not provide training or support for complex tax situations. Volunteers should not complete returns with the following:

- self-employment income or employment expenses * (see Exception 1)

- business income and expenses

- rental income and expenses

- interest income over $1,000

- capital gains or losses

- bankruptcy in the tax year (or the year before, if that return has not yet been filed)

- deceased person

- foreign property (T1135)

- foreign income ** (see Exception 2)

*Exception 1:

Individuals who have a T4A slip, Statement of Pension, Retirement, Annuity, and Other Income, that shows self-employed or business in box 048 may be eligible to have their tax return completed through the CVITP if all of the following conditions are met:

- the total income in box 048 is under $1,000

- no expenses are claimed

- the individual is not registered as a GST/HST registrant and is not required to be one

**Exception 2:

Individuals who receive U.S. Social Security benefits are eligible to have their tax return completed through the CVITP. Any other type of foreign income (including a foreign pension) would not be considered a simple tax situation.

If you meet the eligibility criteria and would like to register for the tax clinic, please click the link below: